VAT registration in the UK : removal of paper forms on November 13, 2023

HMRC has updated this day its guidance on the VAT registration in the UK.

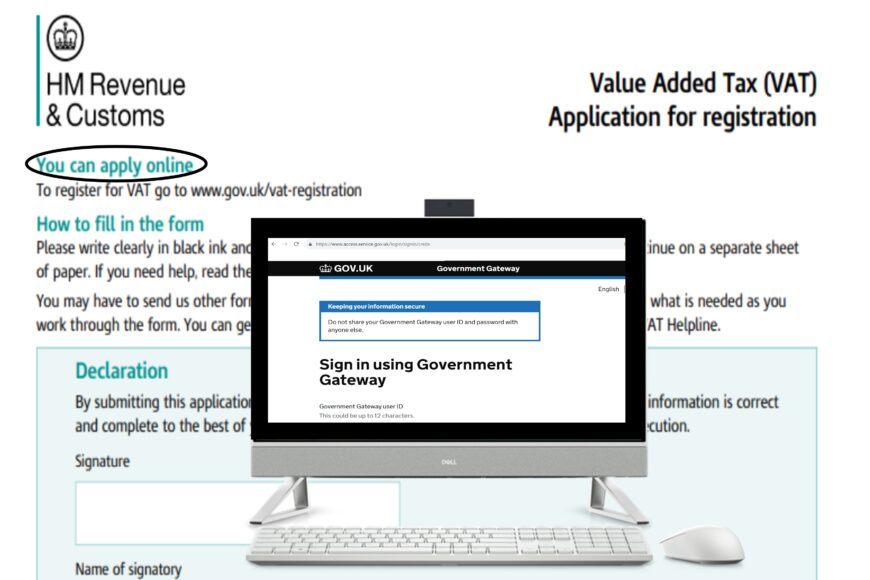

For encouraging businesses to use an existing online-registration portal available on the Government Gateway and for accelerating in this way the process & delivery of VAT numbers, the UK Tax Administration has definitively removed from its official website the application form VAT1.

This form can still be requested by phone via the VAT helpline and it will be delivered by the HMRC agents if the applying business is eligible for the VAT registration by post.

The paper VAT registration is still valid for structures which are :

- a limited liability partnership (LLP) registering as a representative member of a VAT group,

- registering the divisions or business units of a body corporate under separate VAT numbers,

- applying to register an overseas partnership,

- a local authority, parish or district council,

- applying for a registration exception.

The businesses can also be VAT registered by post if the applicant can’t use the online services due to:

- the age, health condition, disability or location,

- any religious grounds,

- the absence of internet access.

The exceptional paper registration can be accepted for any further reasons if validated by HMRC.

BtoBnice will be happy to assist your company with the VAT registration and VAT compliance in the UK.

Feel free to contact us: contact@btobnice.com