E-Reporting France : local and foreign businesses concerned

Adopted last December, the French Finance Act for 2024 confirms the gradual implementation of e-invoicing and e-reporting starting from September 2026.

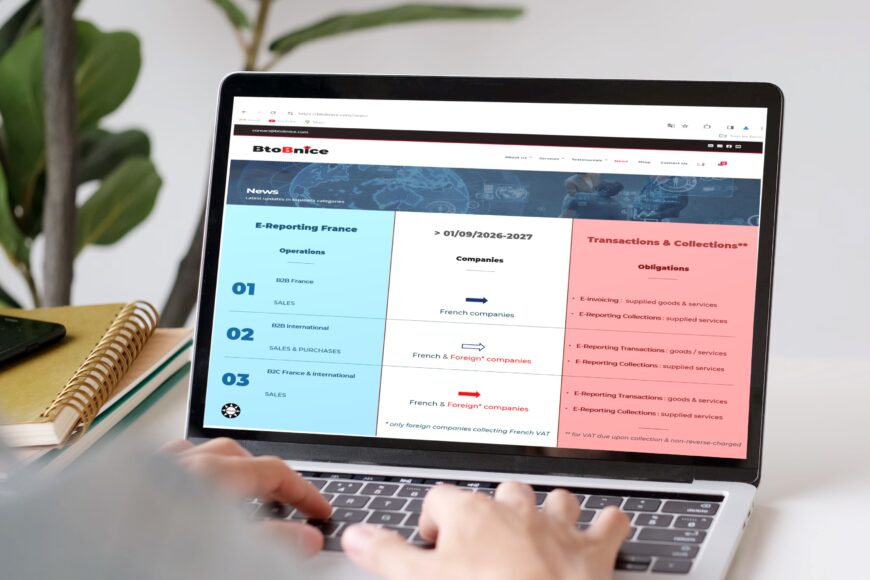

While the e-invoicing concerns only taxable transactions between companies established in France, the e-reporting is covering all the transactions in scope of VAT, including some operations of foreign businesses liable for VAT in France.

The e-reporting will follow the implementation’s schedule of the e-invoicing:

- 01/09/2026: large and mid-cap companies

- 01/09/2027: all other companies

The e-reporting is composed of two parts:

- Reporting of transactions for operations not covered by e-invoicing

- Reporting of collections for supply of services

I. Transactional reporting will concern:

1. Companies established in France

- B2B purchase and sale of goods/services worldwide (excluding imports): EU – outside EU – Monaco – COM – Guyana – Mayotte

- B2C sale of goods/services in France and worldwide

2. Foreign companies liable for VAT in France:

- Sale of goods and services located in France towards taxable persons not established in France

- Local sale of goods towards French individuals

- Distance sale of goods towards French individuals (excluding one-stop-shop supplies)

- Sale of electronic services towards French individuals (excluding one-stop-shop supplies)

- Sale of services located in France towards individuals: real estate related services, cleaning, housekeeping, repair, advice, car rental

In frame of the transactional e-reporting, the declarant must transmit:

- Invoicing data for international operations in B2B and B2C sector

- Transactional data for B2C operations without invoices

The data must include: identification number of the declarant; reporting period or invoice date; option for VAT on debits; transaction’s category; total amount excluding VAT and amount of VAT broken down by tax rate; total amount of VAT due in France; currency; number of daily transactions or invoice number.

The frequency of the transactional e-reporting will depend on the tax regime and on the frequency of VAT declarations due by the tax payer:

- Every 10 days for monthly tax payers: before the 20th and 30th of the current month, and before the 10th of the following month

- Every month for other tax payers: before the 10th (quarterly tax payers) or between the 25th and 30th of the following month (others)

- Bimonthly for companies under the VAT exemption-based regime

II. E-reporting of collections for supply of non-exempted services

This e-reporting requires the payment date for identifying the due date of the VAT collected by taxable persons. Consequently, this obligation does not concern companies having opted for VAT on debits (VAT due based on the date of invoicing), nor reverse-charged transactions (VAT collected by the service purchaser).

The e-reporting of collections is due by:

1. French companies

- Supply of B2G and B2B services in France and internationally

- Supply of B2C services in France and internationally

2. Non-established foreign companies

- Services located in France provided towards non-established taxable persons

- Services located in France provided towards individuals

- Electronic services for French individuals (excluding one-stop-shop supplies)

The e-reporting of collections is completing the obligation of the e-invoicing and of the transactional e-reporting.

In frame of the e-reporting of collections, the declarant must transmit: its identification number, reporting period or invoice date, amount collected broken down by VAT rate + invoice number if applicable.

The frequency of the e-reporting of collections will depend on the tax regime of the declarant:

- monthly for all tax payers: before the 10th (normal real regime) or between the 25th and 30th of the following month (simplified regime)

- bimonthly for companies under the VAT exemption-based regime: between the 25th and 30th of the following month

Transmission of the e-reporting

Both e-reports must be transmitted on the public invoicing portal via manual entry or via the submission of the dematerialised file. The format of the files will be specified later.

The e-transmission can be carried out by the liable company or by a partner dematerialisation platform. The partner platforms having not been accredited by the French tax administration so far, the list of the first candidates can be consulted here.

Penalties for non-compliance

The non-transmission of the e-reporting will be subject to a fine:

- 250 euros per transmission within the limit of 15,000 euros per calendar year for each kind of e-reporting.

A higher fine is foreseen for non-compliant platforms: 750 euros per transmission within the limit of 45,000 euros per calendar year for each kind of e-reporting.

Anticipation

For anticipating the implementation of the French e-invoicing, it is important to check now:

- Your operations concerned by the e-reporting obligation

- The availability of the requested data

- The possibility of data centralisation and data extraction

- The possible means of electronic data transmission

This new reporting obligation, which can seem far, could require some time-consuming updates of accounting software and of IT interfaces.

The choice of the e-transmission method will depend on the internal organisation and on IT needs of each company, as well as on different proposals of future partner platforms.

Foreign businesses accompanied by a tax agent or by a French tax representative (for non-EU- companies) should start questioning their actual service providers about their solutions for the upcoming e-reporting obligations.

We remain at your disposal for any additional information at: contact@btobnice.com