Worldwide VAT reclaim agenda 2024

Reudcing costs of your business purchases abroad

Companies purchasing goods and services abroad or engaging non-domestic travel expenses often pay foreign VAT charged by suppliers of different countries.

This foreign VAT can be claimed back by eligible non-resident companies in front of the competent tax authorities under certain conditions:

- absence of fixed establishment and of taxable operations in the country of expense

- valid VAT registration in the country of establishment

- allocation of expenses to non-exempted business operations

- reciprocity agreement between two countries (not systematically required)

The VAT refund requirements and reclaim procedures are proper to each country or group of countries.

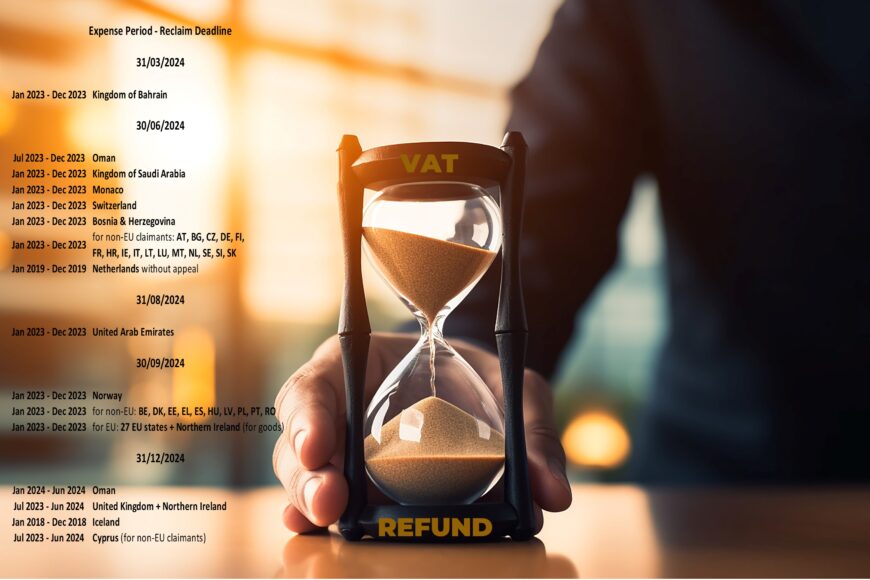

For claiming back the foreign VAT incurred on 2023 business expenses, the non-registered companies should respect the below filing deadlines:

31/03/2024: Kingdom of Bahrain

30/06/2024: Oman (S2/2023), Kingdom of Saudi Arabia, Monaco, Switzerland, Bosnia & Herzegovina

30/06/2024: EU VAT for non-EU claimants: AT, BG, CZ, DE, FI, FR, HR, IE, IT, LT, LU, MT, NL, SE, SI, SK

31/08/2024: United Arab Emirates

30/09/2024: Norway & EU VAT for non-EU claimants: BE, DK, EE, EL, ES, HU, LV, PL, PT, RO

30/09/2024: EU VAT for EU claimants: 27 EU members states & Northern Ireland (for goods)

31/12/2024: Oman (S1/2024), United Kingdom & Northern Ireland (S2/2023 & S1/2024), Cyprus (S2/2023 & S1/2024 for non-EU), Iceland (2018).

Further countries accept VAT refunds towards foreign businesses applying for a local VAT registration or for a specific tax number.

Feel free to contact us for additional information and for operational support with your foreign VAT recovery worldwide: contact@btobnice.com