VAT Recovery in France: French VAT Refunds for Foreign Businesses

French VAT recovery is an opportunity for foreign companies to reclaim VAT incurred in France, following specific procedures.

French VAT can be recovered by companies established outside France.

The procedure for VAT recovery in France differs depending on the place of establishment and the VAT registration status of the foreign business.

French VAT Refund for Foreign Businesses Registered in France

Foreign companies with a valid VAT registration in France can deduct eligible input VAT in their local VAT returns, based on the 6th EU Directive.

The excess input VAT creates a VAT credit, which is refunded by the French Tax Administration upon request, if the claimed amount exceeds €150 for annual declarations or €760 for shorter declarative periods.

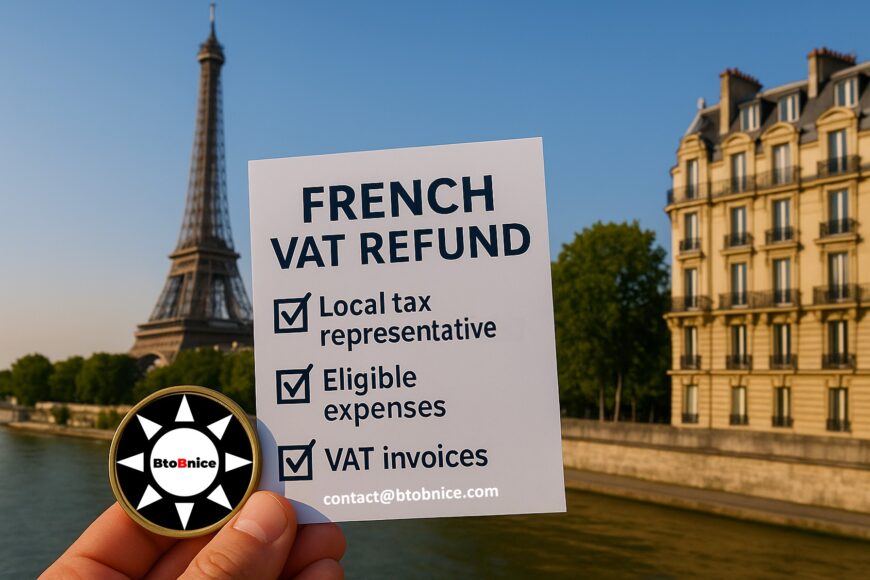

Foreign companies established outside the European Union must appoint a local tax representative to declare their VAT-liable operations in France. The VAT representative must be a taxable person established in France and recognised by the French Tax Authorities.

French VAT refund claims must be filed with the Foreign Business Tax Department that has jurisdiction over the tax representative’s place of business.

Both French VAT deductions and French VAT refund claims must be carried out within two years following the end of the expense year. This means no later than December 31, 2025, for expenses incurred in 2023.

French VAT Refund for Foreign Businesses Without Registration in France

Foreign companies without VAT registration in France can claim back French VAT in accordance with the relevant EU VAT Directives:

- 8th EU Directive for EU companies – with an annual deadline of September 30

- 13th EU Directive for non-EU companies – with an annual deadline of June 30

VAT Recovery in France by EU Businesses

Foreign companies established within the European Union can make a direct VAT reclaim in France through the tax portal of their country of establishment.

A unique annual deadline applies within the EU for foreign VAT refund claims: September 30 of the year following the expense year. Thus, French VAT incurred on 2024 business expenses must be claimed by EU companies by September 30, 2025.

EU companies may appoint a VAT agent to handle their French VAT refund claims.

There are no specific requirements regarding the status or place of establishment of the VAT agent.

However, a power of attorney must be issued by the EU business to the VAT agent and included in the electronic VAT refund application.

VAT Recovery in France by Non-EU Businesses

Foreign companies established outside the European Union must appoint a local tax representative established, VAT registered, and accredited in France.

French VAT refund claims must be filed electronically by the appointed French tax representative and must include, among other documents, a power of attorney issued by the foreign business.

French VAT can be claimed back quarterly, semi-annually, or annually, without exceeding five claims per calendar year. The minimum claimed VAT amount must be €50 for annual reclaims and €400 for shorter periods.

The annual deadline for VAT recovery in France by non-EU businesses is June 30 of the year following the expense year. Thus, French VAT incurred on 2024 business expenses must be claimed by non-EU companies by June 30, 2025.

The French tax representative is jointly responsible for any declarative errors or omissions, as well as any undue French VAT refunds.

Find hereafter the related comments of the French Tax administration: procedure for filing a VAT refund.

VAT Recovery in France: Common Rules and Principles

VAT applies in France to most supplies of goods and services.

The standard VAT rate is 20%.

Reduced VAT rates of 10%, 5.5%, and 2.10% apply to specific categories of goods and services, while some supplies are either zero-rated or exempt from VAT.

French VAT can be deducted and recovered by taxable persons on eligible expenses used for their business operations in France or abroad. Expenses incurred for private use or for VAT-exempt activities are not eligible for VAT refunds in France. For mixed-use goods and services, VAT is recoverable on a pro-rata basis.

The following expenses are explicitly excluded from VAT recovery in France:

- 20% of fuel costs

- Car-related expenses (except for vans, trucks, and specific business sectors)

- Passenger transport

- Accommodation expenses (except for third-party expenses)

- Business gifts over €73 including taxes (for expenses between 2021 and 2025)

French and foreign companies can claim back French VAT incurred on other expenses and purchases, based on VAT-compliant original invoices and bills.

Opportunities for VAT Recovery in France

Being established and VAT registered in France, BTOBNICE is accredited by the French Tax Authorities as a tax representative for non-European businesses.

We act both as VAT agents for European businesses and as French tax representatives for non-EU businesses, handling VAT registration and VAT recovery in France.

Our VAT experts manage the entire VAT recovery process on behalf of our business customers:

- Selection of eligible invoices containing French VAT

- Correction of non-compliant invoices and bills

- Preparation and filing of French VAT refund claims

- Communication with the French Tax Authorities

- Obtention of decisions and French VAT refunds

Our VAT expertise and operational know-how ensure optimised VAT recovery in France and abroad:

quick refunds, maximised VAT amounts, and secure business operations.

Learn more about OUR VAT RECOVERY SOLUTIONS

Feel free to request any additional information or a quote: contact@btobnice.com