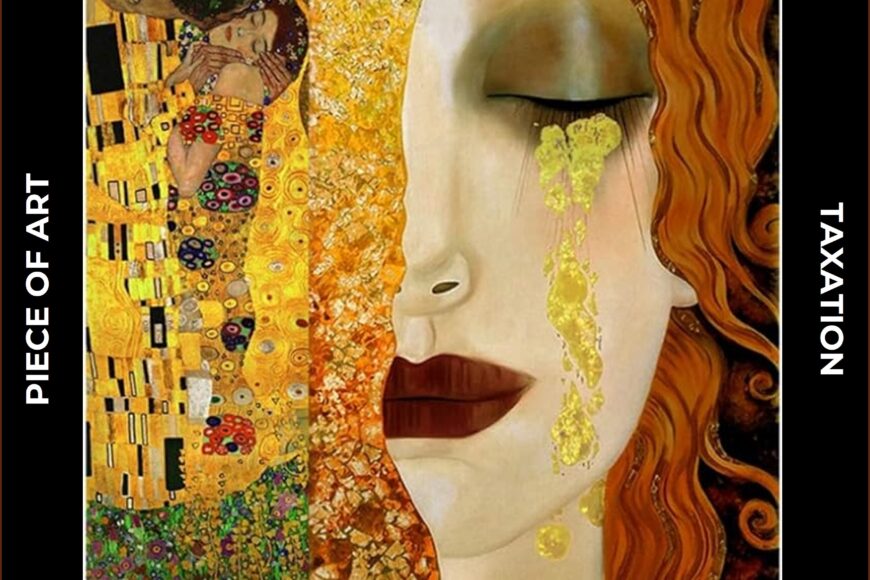

World Art Day 2024 : arts and taxes

On the 15th of April are celebrated the fine arts, in honour of the day of birth of Leonardo Da Vinci. Since its establishment in 2012 by the International Association of Art, the event deems to promote the artistic creation and to reinforce the links of art with society. The 2024 edition of the World Art Day is dedicated to the cultivation of community through art: A garden of expression.

Having significatively evolved during the past centuries, the actual classification of arts includes 10 principal types: architecture, sculpture, painting, music, literature, performing, film, radio & television, comics, video-games.

Works of art

The notion of works of art remains closely linked to visual arts created by hand of artist.

Their definition is important for tax issues.

Thus, the French tax law distinguishes 7 kind of works of art based on their material and form.

Paragraph II of Article 98A of the Annex III of the General Tax Code:

- Pictures, collages and similar small prints, paintings and drawings

- Original engravings, prints and lithographs

- Original productions of statuary art or sculpture in all materials (except jewellery, goldsmith’s and jewellery items)

- Tapestries and wall textiles

- Unique examples of ceramics

- Enamels on copper

- Photographs

Furthermore, specific criteria, such as artist’s signature, number of exemplars and their mandatory numeration are applied to each of the above categories.

For example, the photographs can be considered as works of art if they are “taken by artist, printed by him/her or under his/her control, signed and numbered within the limit of thirty copies, all formats and supports combined“.

Based on the further comments of the French Tax authorities, only “photographs which bear witness to a manifest creative intention on the part of their author can be considered works of art“. (Source BOFIP : BOI-TVA-SECT-90-10)

Taxation

The creations fulfilling the criteria of work of art can enjoy the privileged taxation.

A. Value Added Tax

In terms of the VAT, the works of art can be subject to the reduced VAT rate of 5,5% if they are :

- purchased in France

- imported from outside the EU

- purchased directly from the artist or from his/her right holders.

The reduced rate of 10% applies on works of arts occasionally sold by tax payers after their purchase and use for cultural sponsorship.

Purchased from non-taxable sellers, the works of art are out of scope of VAT.

In all other cases, the standard VAT rate of 20% applies.

The special margin scheme can be optionally applied by resellers of works of art who paid reduced VAT rate (5,5% or 10%) on purchase. Losing the right of VAT deduction, the resellers calculate the due VAT amount on the difference between the sales price and the total purchase price or on the global margin realised during a specific period. Under certain conditions, the promoting resellers (galleries) can calculate the margin through application of the flat rate of 30% on sales price.

🛎️These VAT rules will change from January 2025, in accordance with the Article 83, I-5° to 8° of the finance law for 2024 transposing the Directive EU/2022/542 of April 5, 2022.

- The rate of 10% will be replaced either by the rate of 5.5% or by the rate of 20% for the margin scheme.

- The margin scheme will apply automatically with a VAT rate of 20% on the resale of works of art purchased from a non-taxable seller or from another taxable reseller who has himself applied the margin scheme. But it will be possible to place the sale under the general VAT regime (taxation on the total price), transaction by transaction, by applying the VAT rate of 5.5% on the resale price.

- The margin scheme can no longer apply to the resale of works of art acquired or imported at a reduced rate.

- The derogatory margin flat rate of 30% will be abolished starting from January 1, 2025 being not compliant with the EU VAT directive.

B. Corporate Taxes

In terms of the direct taxation, the net price of works of art can be deducted from the company’s taxable result within 5 years (20% per year), with an annual limit of 20K€ or 5% of the annual turnover. For being eligible for the tax credit, the works of art must be :

- purchased from a living artist

- exposed for free during 5 years

- exposed in a place accessible by public or by company’s employees

- be correctly registered in books

C. Individual taxation

Specific taxation/exemption rules apply on gains obtained upon resale of works of art. The inheritance tax on works of art is following the general rule. As for the wealth tax on real estate replacing the ancient wealth tax in France, it is not applicable on works of art.

The taxation of works of arts being not harmonised within the EU, the rules should be checked separately for each member state.

📧 We invite you to contact our tax experts for any additional information and questions : contact@btobnice.com